For more information about Oracle (NYSE:ORCL), visit. Oracle offers a comprehensive and fully integrated stack of cloud applications and platform services. My Oracle Support provides customers with access to over a million knowledge articles and a vibrant support community of peers and Oracle experts. Oracle E-Business Suite patches to be appliedģ. XRechnung and ZugFeRD 2.0/2.1 represent the national CIUS for eInvoicing and are compliant.

Invoices online 2.0 full#

To view full details, sign in with your My Oracle Support account.ĭon't have a My Oracle Support account? Click to get started!ġ. Use of Core Invoicing Usage Specifications (CIUS) at national level.

This document is to be used by Oracle E-Business Suite customers having Oracle Receivables who need to issue electronic invoices based on the UBL 2.1 standard. This document will provide an overview of the UBL electronic invoicing solution for Oracle Receivable.

Information in this document applies to any platform. business entities receive support for more efficient and competitive operations in the national and global context.UBL Electronic Invoice solution for Oracle Receivables.

Invoices online 2.0 archive#

Invoices online 2.0 pro#

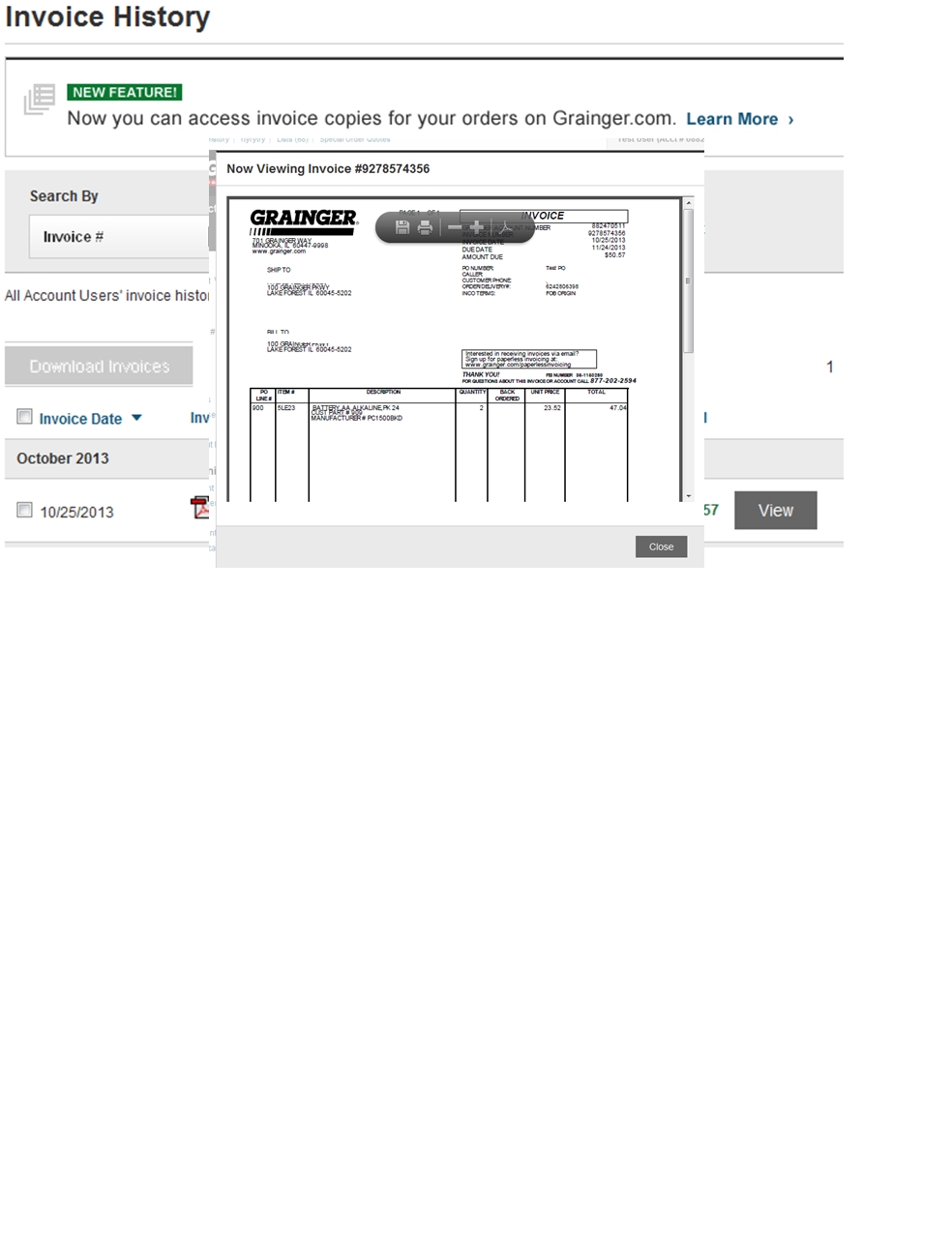

Equipment invoices can be paid online via electronic check only. InstaForm Invoices & Estimates Pro 2.0 lets you spend more time growing your business and less time on paperwork. implementation of a cashless payment system via an electronic invoice (eInvoice) in the B2B (business-to-business) segment with an integrated e-archive and active, unique and advanced online bookkeeping in the VAT system Login to Existing Account Credit Card Service Fees Beginning JGregory Poole will institute credit card service fees following the below guidelines: Parts, rental and service invoices can all be paid with a credit card or electronic check.establishment of a system for reporting non-cash receipts to the Tax Administration, namely receipts issued by state administration bodies today - fiscalization of receipts issued in the B2G (Business to Government) segment.

As part of the Fiscalization 2.0 project, it is planned to:

0 kommentar(er)

0 kommentar(er)