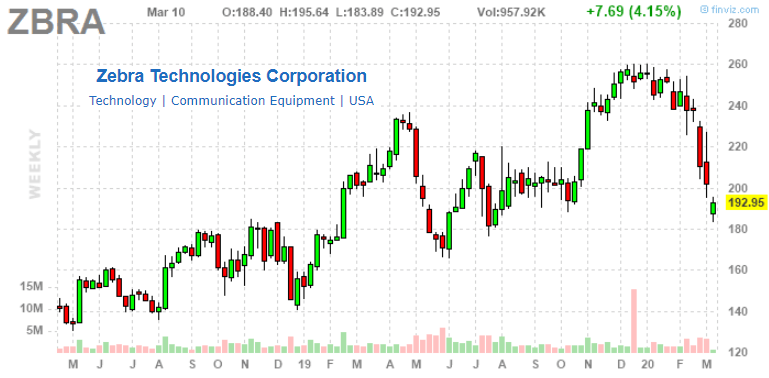

Sales were up just 2.7 per cent to $5.781 billion for Zebra’s 2022 year, which compared to the huge 26.5 per cent leap the company made between 2021’s revenue and 2022. But we think it’s a good time to own the stock here,” he said. “They grew very rapidly through the COVID period and then now they’re digesting all that growth, like you’ve seen with a lot of other tech companies. They’re a major player in that and there aren’t that many people that participate in their field with them,” said Harris of Harris Douglas Asset Management, who spoke on a BNN Bloomberg segment on Tuesday. “We like the story because we think e-commerce is going to continue to grow. The stock fell with the rest of the tech market in late 2021, going from $600 to half that in short order and has bumped around the $250-$350 range for the past year.īut portfolio manager Paul Harris thinks investors will do well by Zebra, since it’s got a good grip on its piece of the e-commerce pie.

#NASDAQ ZBRA FINANCIALS SOFTWARE#

They make, for instance, RFID codes to ship and track packages but they also do hardware like handheld devices and robotics and software that incorporates AI and machine learning to help with automation and imaging. Validea offers both stock analysis and model portfolios based on gurus who have outperformed the market over the long-term, including Warren Buffett, Benjamin Graham, Peter Lynch and Martin Zweig.Zebra Technologies ( Zebra Technologies Stock Quote, Charts, News, Analysts, Financials NASDAQ:ZBRA) is a printing company specializing in automatic identification and data capture technology. Watson Chair in Value Investing at the University of Toronto and was previously an Associate Professor at the Columbia Business School.Ībout Validea: Validea is an investment researchservice that follows the published strategies of investment legends. His research paper "Separating Winners from Losers among Low Book-to-Market Stocks using Financial Statement Analysis" looked at the criteria that can be used to separate growth stocks that continue their upward trajectory from those that don't. Mohanram turned that research on its head by developing a growth model that produced significant market outperformance. While academic research has shown that value investing works over time, it has found the opposite for growth investing. Partha Mohanram is a great example of this. Sometimes research that changes the investing world can come from the halls of academia. RETURN ON ASSETS:ĭetailed Analysis of ZEBRA TECHNOLOGIES CORP.Ībout Partha Mohanram: Sometimes the best investing strategies don't come from the world of investing. Not all criteria in the below table receive equal weighting or are independent, but the table provides a brief overview of the strong and weak points of the security in the context of the strategy's criteria.ĬASH FLOW FROM OPERATIONS TO ASSETS VS.

The following table summarizes whether the stock meets each of this strategy's tests.

0 kommentar(er)

0 kommentar(er)